Basic Concepts of the EU Carbon Border Control Mechanism

European Union carbon border control mechanismCBAM isAlso known as carbon border tax or carbon tariff, it is a tax imposed by the EU on the carbon emissions of some imported goods. Simply put, it is through CBAM to adjust the price difference for the same amount of carbon emitted within and outside the EU territory, so that the price required to pay for the same amount of carbon emissions inside and outside the EU is basically equal.

CO2 emissions scope of the EU carbon border control mechanism

According to the EU Bill, the CBAM mechanism mainly covers three categories of carbon emissions: direct carbon emissions, indirect carbon emissions, and complete carbon footprint. These carbon emissions cover all greenhouse gas emissions from raw material mining, production process, to product transportation, use, and disposal/disposal phase.

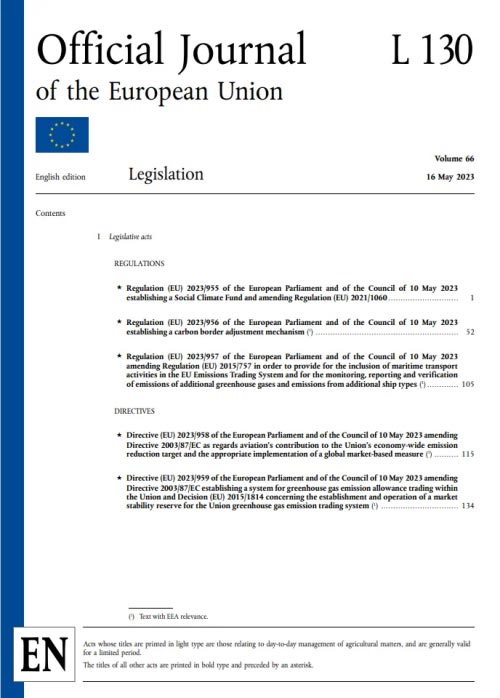

The implementation of the EU Carbon Border Control Mechanism

CBAM will be officially launched on October 1, 2023, and implemented in 2026. The transition period from October 1, 2023 to December 31, 2025 will be the period during which companies will only have to comply with their reporting obligations to submit annual data on the implicit carbon emissions of imported products without paying a fee for this.

Declaration process for the EU Carbon Border Control Mechanism

CBAM fee clearance is carried out by the unified executive body established by the European Union. EU importers must apply to that executive body for the qualification for import declaration of products within the scope of CBAM, and can carry out data declaration and fee clearance of relevant import products after being approved as an authorized declarant.

Response Strategy for Chinese Exporters

Chinese exporters should prepare ahead of the window, including checking important data such as implied emissions of exported goods, collecting and storing certification of carbon prices paid, and accelerating the transition to a low-carbon strategy.

Follow Customer Service WeChat

Follow Customer Service WeChat