Does an agent need to pay VAT for export? How is the export tax rebate calculated? The latest tax guide in 2025

March 27, 2025

23. Does agency export need to pay value - added tax? According to the current policies in 2025, the value - added tax zero - rate policy applies to agency export business: No value - added tax is paid in the goods export link The service agency fee is subject to a 6% value - added tax Special circumstances: For goods prohibited/restricted from export, the tax already refunded needs to be repaid Failure to declare for tax refund within the specified time limit is regarded as domestic sales and tax needs to be supplemented Export tax...

38. What problems can the import and export agency service solve for you exactly?

49. March 28, 2025

What kind of service is import and export agency? Import and export agency is a legal intermediary service institution filed with the customs, assuming the dual roles of a trade compliance executor and a supply chain coordinator. According to the Regulations on the Record - keeping Administration of Customs Declaration Entities revised by the General Administration of Customs in 2022, a regular agency enterprise must have: Customs AEO certification qualification, Electronic Port operation authority, At least...

How to Do the Customs Declaration Agency for Refrigerator Exports? The Most Comprehensive Process Analysis in 2025

March 30, 2025

Subscribe to change notifications through the Enterprise Credit Publicity System on the Single Window

How to review an import and export agency agreement? These 8 key questions must be clearly asked!

Leverage Data Advantages: Providing complete customs declaration materials can waive the document modification fee (originally 200 yuan/time)

What documents are needed for agent qualification review? We recommend requiring agents to provide these three types of documents: Basic qualifications: Import/export rights certificate, Customs AEO certification, SAFE registration Professional capability proof: Past 3 years import/export declarations for similar products (desensitized), international freight forwarding certificates Industry reputation documents...

How to add the profit of agent - declared export? Have you calculated these hidden costs clearly?

Leverage Data Advantages: Providing complete customs declaration materials can waive the document modification fee (originally 200 yuan/time)

What costs are actually included in agency customs clearance fees? Agency customs clearance profits typically comprise three core modules: Basic service fees (document processing, system declarations) Government fee collection (customs inspection fees, port charges) Value-added services (expedited clearance, tax rebate consulting). 2025 data shows basic service fees account for about 40% of quotes, of which...

It is recommended to avoid cost traps through Three Checks:

April 2, 2025

Why must customs clearance be handled through professional agents? What are the risks of self-filing? According to the Administrative Measures for Import and Export Goods Declaration issued by the General Administration of Customs in 2025, enterprises handling self-filing must meet three mandatory conditions: Possessing AEO Advanced Certification from customs, Employing at least 2 licensed customs declarants, Handling over 500 customs declarations annually. Actual cases show that a cross-border e-commerce...

Where can I query the export agency certificate number? The latest guide in 2025

April 2, 2025

What is an export agency certificate number? In import and export business, export agency certificate numbers typically refer to two types of important credential numbers: Customs declaration number: An 18-digit unique code generated by the customs system, Agency power of attorney number: The contract filing number in foreign trade agency agreements. Since 2025, the General Administration of Customs has fully implemented an electronic customs declaration system, with paper declarations serving only as supplementary...

What exactly is export factoring financing? How can enterprises use it to alleviate financial pressure?

How exactly is the export tax rebate calculated?,

What is an agency export invoice? How does it differ from regular invoices? The agency export invoice (Proforma Invoice) is a core document in foreign trade agency business, fundamentally different from regular VAT invoices: Different legal nature: Belongs to commercial credit documents rather than tax documents Different issuing entities: Issued by foreign trade agency companies on behalf of manufacturers Content elements...

What exactly is the difference between export agency and customs declaration agency? How should foreign trade companies choose?

How exactly is the export tax rebate calculated?,

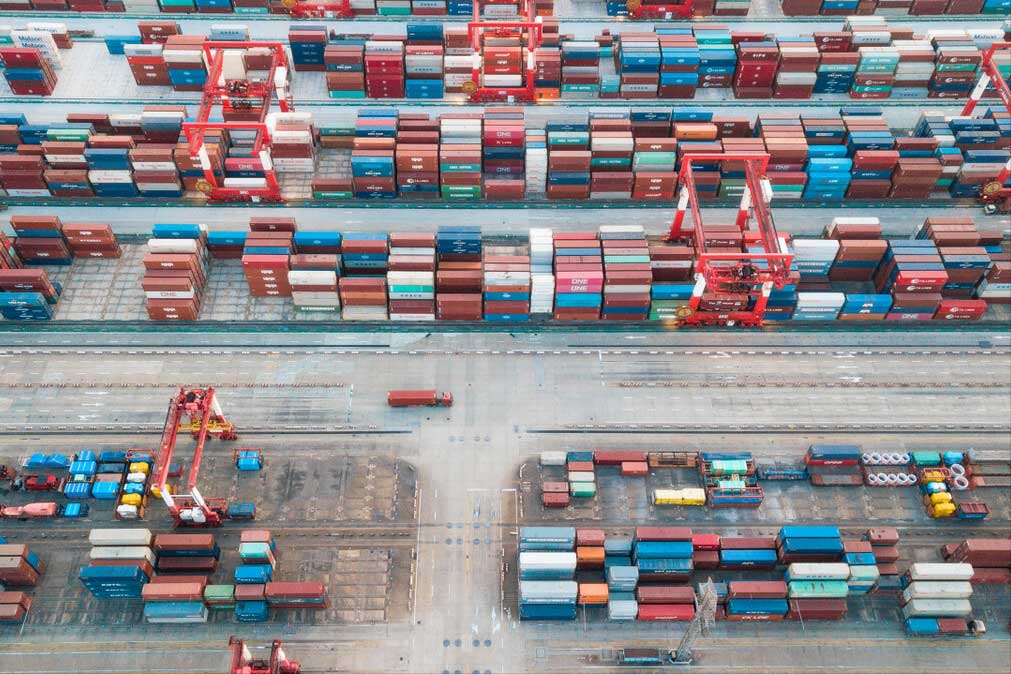

Why are agency export and agency customs clearance considered two completely different service systems? In 2025 international trade practice, agency export services refer to qualified agency enterprises handling the entire export process, including signing foreign trade contracts, arranging logistics, customs clearance, inspection, and foreign exchange settlement. Agency customs clearance services focus specifically on customs clearance...

Follow the customer service WeChat account.

Follow the customer service WeChat account.